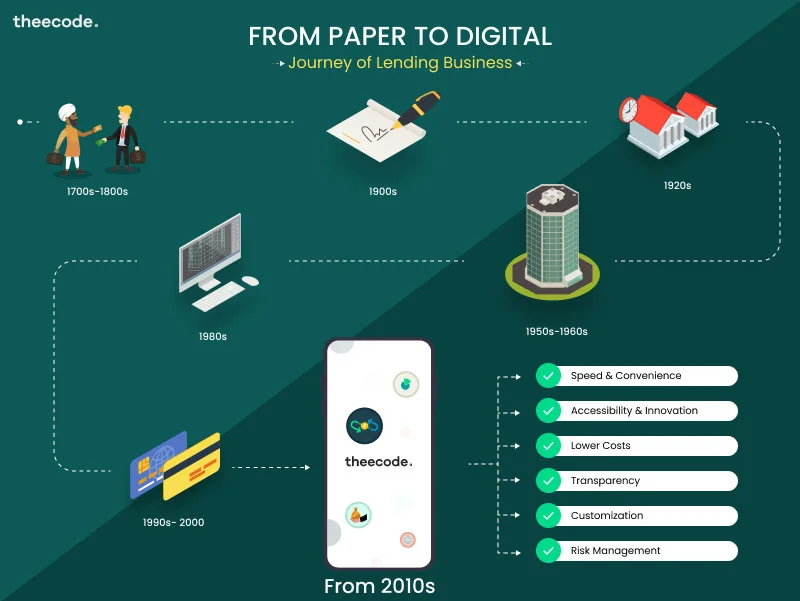

From Paper to Digital: The Journey of the Lending Business

The history of lending is almost as old as civilisation itself. Ancient Mesopotamian tablets record loans of grain and silver dating back more than 4,000 years. While the fundamental act of borrowing has remained constant, the mechanisms for recording, underwriting and servicing loans have evolved dramatically. For much of the 20th century, lending was a paper‑intensive business. Borrowers filled out lengthy forms, banks maintained filing cabinets of documents, and decisions were made through manual credit checks and personal judgement. The journey from paper to digital has transformed not only how lenders operate but also who gets access to credit. This article traces the evolution of lending processes, the technology innovations that catalysed change and the implications for lenders and borrowers as we move toward a fully digital future.

In the early days of modern banking, record‑keeping was meticulous and labour‑intensive. Bank clerks manually wrote ledgers, calculated interest and maintained correspondence. Loan officers relied on personal relationships and local knowledge to evaluate creditworthiness. The 1950s saw the advent of credit bureaus and credit scoring, which began to standardise risk assessment. However, information flowed slowly. Loan applications were mailed, faxed or delivered by courier. Approval often took weeks. This paper‑driven process limited lending to individuals and businesses with established relationships and excluded many potential borrowers. The introduction of mainframe computers in the 1960s and 1970s allowed banks to digitise some functions, but the front end remained largely manual. The mortgage industry, for example, continued to require thick packets of documents and wet signatures well into the 2000s.

Key Drivers of Digital Transformation

Several drivers propelled the lending business from paper to digital. The first was technological advancement. The proliferation of personal computers in the 1980s and the rise of the internet in the 1990s enabled data to be captured, stored and transmitted electronically. Banks began offering online loan applications, and early fintech startups explored digital alternatives to traditional bank loans. The second driver was regulatory change. In many jurisdictions, e‑signature laws were introduced, giving legal recognition to electronic contracts. This eliminated the need for physical signatures and sped up loan origination. The third driver was competition. As new entrants leveraged technology to offer faster and more convenient lending, incumbents faced pressure to modernise. The global financial crisis of 2008 also exposed the limitations of manual processes, as lenders struggled with document backlogs and inconsistent risk assessments. The crisis spurred investment in digital infrastructure to improve transparency and resilience.

The rise of smartphones and mobile internet in the 2010s accelerated digitalisation further. Consumers grew accustomed to digital experiences in shopping, entertainment and communication. They expected the same convenience in financial services. Fintech companies like LendingClub, Prosper and later SoFi introduced peer‑to‑peer and online lending models, enabling borrowers to apply for and receive loans without visiting a branch. Banks responded by streamlining online applications, integrating digital document uploads and automating credit checks. The adoption of cloud computing allowed institutions to scale their digital platforms efficiently. Artificial intelligence and machine learning emerged as powerful tools for underwriting and fraud detection. By the 2020s, digital lending had become mainstream, with many lenders closing physical branches and focusing on omni‑channel delivery.

From Origination to Servicing: The Digital Workflow

Modern lending workflows are designed to minimise friction and maximise efficiency. The journey begins with the borrower application. On a digital platform, applicants provide personal and financial information through online forms or mobile apps. Data validation occurs in real time, using APIs to fetch bank statements, tax returns and identity documents. Video KYC (Know Your Customer) processes allow borrowers to verify their identity without visiting a branch. Artificial intelligence analyses hundreds of variables—income stability, spending patterns, credit history and even behavioural data such as how quickly the applicant fills out the form. This analysis produces a risk score and an interest rate tailored to the borrower’s profile.

Once the loan is approved, disbursement happens instantly via electronic funds transfer. Loan agreements are signed with digital signatures, and documentation is stored in the cloud. During the servicing phase, digital platforms provide borrowers with dashboards to track repayment schedules, outstanding balances and interest accrual. Automatic payment reminders and direct debit options reduce delinquency. For lenders, digital systems monitor repayment behaviour and flag potential issues early. If a borrower falls behind, the collections process is initiated through automated communication channels, and agents are assigned cases based on risk profiles. Digital servicing ensures that information is always up to date and accessible to both borrower and lender. It also reduces operational costs by eliminating manual processing and paper handling.

Benefits for Borrowers and Lenders

Digital lending offers significant benefits for borrowers. The most obvious is speed. What once took weeks can now be accomplished in minutes. Borrowers can compare offers from multiple lenders online, increasing competition and reducing interest rates. Digital platforms make credit accessible to populations previously excluded due to geography or lack of credit history. Alternative data sources, such as mobile phone usage and e‑commerce transactions, provide insight into borrowers’ financial behaviour, enabling lenders to assess creditworthiness more accurately. Borrowers also enjoy transparency; digital portals display fees, interest rates and repayment schedules clearly, allowing informed decisions.

For lenders, digitalisation reduces operational costs and expands market reach. Automated underwriting and servicing lower the need for large back‑office teams. Data analytics improve risk management, enabling lenders to price loans more accurately and detect fraud. Scalability is another advantage. With cloud infrastructure and SaaS platforms, lenders can originate and manage thousands of loans without corresponding increases in headcount. Digitalisation also opens new distribution channels. For example, embedded lending allows consumers to access credit within e‑commerce or gig economy platforms, driving growth. By partnering with fintechs or leveraging API ecosystems, traditional lenders can extend their products to new customer segments. However, these benefits come with challenges around cybersecurity, data privacy and regulatory compliance, which must be addressed proactively.

Challenges and Considerations

Despite its advantages, the digital transformation of lending poses challenges. Cybersecurity threats have increased alongside digital adoption. Data breaches can expose sensitive personal and financial information, leading to financial loss and reputational damage. Lenders must invest in robust security measures, including encryption, multifactor authentication, regular audits and compliance with data protection laws. Another challenge is digital inclusion. Although mobile internet penetration has grown, some populations still lack access or digital literacy. Lenders must ensure that digitalisation does not exacerbate inequality. Hybrid models that combine digital channels with human support can bridge this gap.

Regulatory compliance is another critical consideration. Different jurisdictions have varying rules around digital signatures, privacy, consumer protection and cross‑border data transfer. Lenders must navigate this regulatory patchwork while maintaining agility. In some cases, regulators have been slow to update rules, creating uncertainty. Collaboration between regulators and industry is essential to foster innovation while protecting consumers. Finally, the shift from paper to digital changes the skillset needed within lending institutions. Teams must evolve from manual processing to data analysis, customer experience design and cybersecurity. Continuous training and change management are crucial to a smooth transition.

Future Directions

The journey from paper to digital is ongoing. Emerging technologies will continue to reshape lending. Artificial intelligence will become more sophisticated, providing predictive insights into borrower behaviour and macroeconomic trends. Decentralised finance (DeFi) platforms and blockchain could enable peer‑to‑peer lending and collateral management with greater transparency. Digital identity systems, such as India’s Aadhaar or Europe’s eIDAS, will streamline onboarding globally. Open banking regulations will allow borrowers to share their financial data with multiple lenders, increasing competition and driving personalised offers. Embedded finance will blur the lines between lending and other services, enabling credit to be offered at the point of sale. As these technologies mature, we may see a world where lending is instantaneous, contextual and personalised—a far cry from the paper‑laden processes of the past.

However, the human element should not be forgotten. Digital platforms can deliver speed and efficiency, but empathy and trust remain integral to financial relationships. Lenders must balance automation with human oversight, particularly in complex or sensitive cases. They must also ensure that decisions made by algorithms are fair, transparent and free from bias. Ethical AI frameworks and explainability will become essential. In the end, digital transformation is not just about replacing paper with pixels; it is about reimagining lending to be more inclusive, responsive and resilient.

Conclusion

The shift from paper‑based lending to digital platforms marks a revolution in financial services. Driven by technology, regulation and competition, digitalisation has made lending faster, more accessible and more efficient. Borrowers benefit from convenience and transparency, while lenders gain scalability and better risk management. The transformation is not without challenges—security, inclusion and compliance require careful attention. As we look ahead, emerging technologies such as AI, blockchain and open banking will continue to evolve the lending landscape. By embracing digital innovation and maintaining a human‑centred approach, lenders can build systems that serve borrowers better and contribute to broader economic prosperity. From clay tablets to cloud servers, the journey of lending demonstrates how finance adapts to humanity’s needs and aspirations.