How Can a Lender Utilize an LMS to Enhance Lending Operations?

The lending industry has experienced a surge of digital transformation over the past decade, driven by changing consumer expectations, competitive pressures from fintechs and new regulatory requirements. At the heart of this transformation is the Loan Management System (LMS), a software platform that automates and orchestrates the entire loan lifecycle—from origination through servicing and collections. For lenders seeking to improve efficiency, reduce risk and enhance customer experience, an LMS is not just a back‑office tool but a strategic asset. This article explores how lenders can leverage an LMS to streamline operations, analyse data and deliver personalised borrower journeys. It also examines the features that differentiate modern LMS platforms and offers guidance on selecting and implementing the right system.

Traditionally, lending operations have been fragmented across multiple systems and manual processes. Loan officers might originate applications using one platform, underwriters evaluate creditworthiness with another, and servicing teams use spreadsheets or legacy software to track repayments. This fragmentation leads to inefficiencies, errors and poor data visibility. An LMS consolidates these functions into a single, integrated platform. It collects borrower information, underwrites applications using automated scoring models, generates loan documents, manages disbursements, tracks payments and triggers collections when necessary. By centralising data and processes, the LMS eliminates redundant data entry, accelerates decision‑making and reduces the risk of manual mistakes. Moreover, it provides a unified view of each borrower’s journey, enabling lenders to deliver consistent and transparent experiences.

Key Features of a Modern LMS

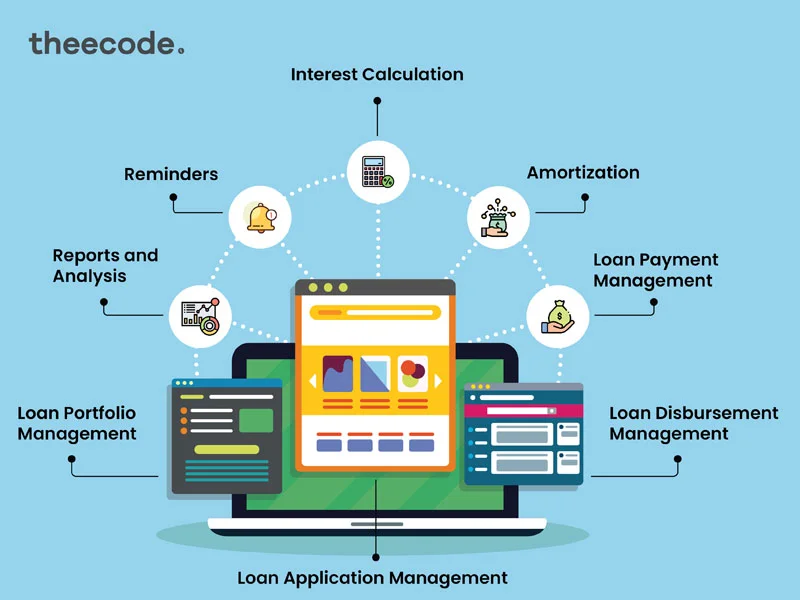

An effective LMS offers a range of features that address the needs of diverse lending products—from personal loans and mortgages to microcredit and lines of credit. Here are some of the key capabilities that differentiate modern LMS platforms:

1. Automated Onboarding and KYC: Modern LMS solutions facilitate seamless onboarding by integrating with electronic Know Your Customer (eKYC) services, identity verification providers and document management systems. Borrowers can upload documents through self‑service portals or mobile apps, and the LMS automatically extracts and verifies relevant information. Facial recognition, OCR and AI‑powered fraud detection reduce onboarding times from days to minutes while ensuring compliance with anti‑money laundering regulations.

2. Configurable Workflows: Lenders often offer multiple loan products, each with unique approval processes. A good LMS allows users to design workflows that reflect internal credit policies and regulatory requirements. For example, a small business loan might require credit committee approval, whereas a small consumer loan could be approved automatically based on defined criteria. Configurable workflows enable lenders to adapt quickly to new products or changing regulations without relying on software developers.

3. Risk Assessment and Underwriting: Modern LMS platforms integrate scoring models that evaluate credit risk using traditional and alternative data. They can pull credit bureau reports, bank statements, transaction histories and social signals. AI‑driven models can predict default probabilities and recommend appropriate interest rates or collateral requirements. Lenders can also incorporate manual review steps for high‑risk cases. By centralising risk assessment, the LMS ensures consistent and auditable credit decisions.

4. Disbursement and Payment Processing: Once a loan is approved, the LMS handles disbursement to the borrower’s bank account or mobile wallet. It integrates with payment gateways and banking APIs to automate these transfers. During servicing, the LMS schedules recurring payments, monitors due dates and reconciles incoming funds. It can send reminders to borrowers ahead of repayment dates and automatically adjust schedules when holidays or payment holidays occur. This reduces late payments and improves cash flow management.

5. Collections and Recoveries: When borrowers fall behind, the LMS triggers collections workflows. Automated messages are sent via email, SMS or in‑app notifications, and agents receive case assignments based on borrower profiles. The system tracks promises to pay, follow‑up dates and outcomes. Integrations with external collections agencies enable seamless escalation when necessary. Having collections functionality built into the LMS ensures that delinquent accounts are managed consistently and in compliance with regulations.

6. Reporting and Analytics: Data is the currency of modern finance. An LMS aggregates data across the loan lifecycle, enabling lenders to generate regulatory reports, operational dashboards and strategic insights. Reports can be customised for different audiences—from branch managers needing portfolio performance data to executives monitoring profitability and risk. Real‑time analytics allow lenders to track delinquency trends, segment borrowers and identify cross‑selling opportunities. Some LMS platforms incorporate machine learning to suggest actions that improve portfolio health.

Integration and Interoperability

A key advantage of an LMS is its ability to integrate with other systems. Lending does not operate in a vacuum. A typical lender interacts with credit bureaus, payment processors, core banking systems, CRM tools and compliance platforms. Modern LMS solutions provide APIs and webhooks that facilitate these connections. For example, when a borrower submits an application, the LMS can automatically query a credit bureau for a score, retrieve bank statements via open banking APIs and verify identity through a third‑party service. When a payment is received, the LMS updates the borrower’s account in real time and triggers acknowledgments. Integration ensures data consistency and reduces manual work. It also enhances customer experience by providing instant decisions and transparent status updates.

For lenders with existing core banking systems or legacy software, interoperability is crucial. Many organisations operate technology stacks built up over decades. Replacing these systems outright can be risky and expensive. A modern LMS should be able to coexist with legacy systems, acting as a layer of innovation. It can pull data from these systems, transform it and present it in user‑friendly dashboards. Over time, lenders may choose to phase out legacy components, but in the interim the LMS acts as a bridge that delivers modern functionality without causing operational disruptions. Open architecture and adherence to industry standards (such as ISO 20022 for payments) ensure that the LMS remains future‑proof and adaptable.

Enhancing Customer Experience

In a crowded lending marketplace, customer experience is a key differentiator. Borrowers expect fast, digital interactions that mirror the convenience of e‑commerce and ride‑hailing platforms. An LMS contributes directly to this experience by enabling self‑service. Borrowers can check loan statuses, make payments and request statements through online portals or mobile apps. Push notifications remind them of upcoming due dates and provide personalised offers. Chatbots powered by artificial intelligence can answer common queries around the clock, while live agents handle complex issues. By reducing friction and providing transparency, the LMS fosters trust and encourages repeat business. A happy borrower is more likely to refer others, lowering acquisition costs.

Moreover, an LMS can enable financial education. Many borrowers, especially in emerging markets, may be unfamiliar with credit products. The LMS can deliver educational content—videos, quizzes and interactive modules—within the borrower portal. It can also offer budgeting tools that help borrowers track income and expenses, enabling them to make informed repayment decisions. When borrowers understand how interest accrues, what happens when payments are late and how to improve their credit scores, they are more likely to manage loans responsibly. This education benefits the lender too, as informed borrowers tend to have lower default rates. Some lenders even gamify repayment, awarding points or rewards for on‑time payments that can be redeemed for discounts on future loans or other benefits.

Operational Efficiency and Cost Reduction

Beyond customer experience, an LMS drives operational efficiency. Automated workflows reduce manual effort, freeing staff from repetitive tasks. Underwriters can focus on exception handling rather than routine approvals. Collections teams can prioritise accounts based on risk, avoiding blanket outreach. Managers have access to dashboards that highlight issues before they become crises. In regulated environments, the LMS ensures that processes are standardised and auditable. This reduces the risk of compliance violations and associated penalties. Moreover, automation reduces processing times, accelerating revenue recognition and improving cash flow.

Cost reduction is another significant benefit. With an LMS, lenders can scale their operations without proportionately increasing staff. Cloud‑based LMS platforms operate on subscription models, lowering upfront capital expenditure. They can also be updated frequently with new features and security patches, reducing the burden on internal IT teams. For organisations that operate across multiple geographies or subsidiaries, a centralised LMS offers economies of scale. Data governance becomes simpler as information is stored in one system rather than scattered across branches. Overall, the LMS enables lenders to deliver more loans with fewer resources, increasing profitability.

Regulatory Compliance and Risk Management

Lending is a heavily regulated industry, and compliance requirements can vary by region and product type. An LMS embeds regulatory compliance into workflows, ensuring that each loan follows prescribed procedures. For example, it can enforce interest rate caps, generate amortisation schedules that meet legal standards, and provide audit trails for all user actions. In jurisdictions that require specific disclosures, the LMS can automatically include these in loan documents. Additionally, advanced LMS platforms monitor regulatory changes and can update workflows accordingly. This ensures that lenders remain compliant without having to rebuild processes each time rules change. From a risk management perspective, centralising data allows for more accurate portfolio analysis. Lenders can segment borrowers, identify concentrations of risk and adjust credit policies proactively. Early warning systems can trigger interventions when delinquency metrics cross thresholds, enabling lenders to mitigate losses before they spiral.

Another key aspect is data security. An LMS stores sensitive personal and financial information. Lenders must implement robust cybersecurity measures to protect data from breaches. This includes encryption at rest and in transit, role‑based access controls, multi‑factor authentication and regular security audits. Regulatory frameworks like GDPR and India’s Digital Personal Data Protection Act impose strict requirements on data processing and storage. The LMS should support these requirements by logging access, providing consent management tools and offering data deletion capabilities. By building compliance and risk management into the system, lenders reduce the likelihood of fines and reputational damage.

Implementation Considerations

Selecting and implementing an LMS is a major undertaking that requires cross‑functional collaboration. Stakeholders from credit, operations, IT, compliance and sales must be involved. The first step is to define requirements. What loan products will the LMS support? Which integrations are essential? What are the regulatory constraints? A detailed requirements document will guide the vendor selection process. Lenders should evaluate potential LMS providers based on functionality, scalability, security, regulatory expertise and customer support. It is also advisable to consider the vendor’s roadmap. A platform that is actively innovating will stay relevant as the lending landscape evolves.

Implementation often occurs in phases. Lenders may start with a single product line or region and expand as the system stabilises. Training is critical. Users must understand not only how to navigate the LMS but also the rationale behind workflows and data fields. Post‑implementation, lenders should establish feedback loops to identify pain points and areas for improvement. A dedicated project team can manage updates, monitor performance and coordinate with the vendor. While implementation can be resource intensive, the long‑term benefits of efficiency, compliance and agility outweigh the initial investment. Lenders that approach LMS deployment strategically will avoid common pitfalls and maximise return on investment.

The Future of LMS Technology

The future of Loan Management Systems lies in greater intelligence, adaptability and integration. Artificial intelligence will become more deeply embedded, not only in credit scoring but also in workflow optimisation. For example, AI could recommend adjustments to underwriting criteria based on macroeconomic indicators or predict which borrowers are likely to respond positively to certain collection strategies. Machine learning algorithms could also detect patterns of fraud or identify borrowers who may benefit from financial counselling. Additionally, open banking and embedded finance trends will require LMS platforms to connect with an ever‑growing ecosystem of data sources and financial services. APIs will become the conduit through which lenders access new datasets, integrate with partners and deliver hyper‑customised products.

Another emerging trend is decentralised finance (DeFi) and blockchain. While mainstream adoption remains nascent, some lenders are experimenting with distributed ledger technology to manage loan servicing, automate smart contracts and create transparent audit trails. An LMS that can interface with blockchain networks may offer new opportunities for asset tokenisation and peer‑to‑peer lending. Furthermore, regulators are increasingly supportive of digital innovation, as seen in regulatory sandboxes and digital banking licences. LMS vendors that actively engage with regulators and incorporate compliance by design will be better positioned to enable lenders to take advantage of these opportunities. Ultimately, the LMS of the future will be a dynamic platform that evolves alongside the financial ecosystem, offering lenders the agility to respond to shifting market demands and regulatory landscapes.

Conclusion

A Loan Management System is more than a technological upgrade—it is a strategic enabler for lenders seeking to thrive in a digital world. By centralising data, automating workflows and integrating with external services, an LMS enhances operational efficiency, risk management and customer experience. Key features such as automated onboarding, configurable workflows, advanced risk assessment, seamless disbursement, integrated collections and rich analytics offer lenders the tools they need to scale responsibly. Interoperability ensures that the LMS fits into existing technology stacks and adapts to future innovations. Implementing an LMS requires careful planning and stakeholder alignment, but the payoff is substantial. As technology continues to evolve and regulatory expectations rise, lenders that invest in a modern LMS will be better equipped to serve their borrowers, protect their portfolios and seize new opportunities in an ever‑changing financial landscape.