Future Prediction of the Lending Market: Looking Back at 2023

Predictions are a hallmark of the financial industry. Analysts, investors and policymakers continually forecast how markets will evolve. In 2023, the lending sector was the subject of many such predictions. Observers expected continued digital transformation, growth in alternative lending models, increased regulatory scrutiny and shifts in interest rate dynamics. Now, with the benefit of hindsight and data from 2025, we can assess which predictions were accurate, which fell short and which unexpected developments reshaped the lending landscape. This article revisits the forecasts made for 2023, analyses how the lending market actually evolved and identifies the trends that will shape the industry in the years ahead.

In early 2023, the global economy was emerging from the COVID‑19 pandemic and facing new uncertainties. Inflation surged across many regions, prompting central banks to raise interest rates. Supply chain disruptions persisted, and geopolitical tensions affected commodity markets. These macroeconomic factors influenced lending in multiple ways. Higher rates increased borrowing costs, but pent‑up consumer demand drove loan growth. Governments and regulators focused on promoting financial stability, digital inclusion and consumer protection. Against this backdrop, industry commentators offered predictions that ranged from bullish optimism to cautious pragmatism. Let us examine these forecasts and their outcomes.

Prediction 1: Digital Lending Will Dominate

One widely held prediction was that digital lending would become the dominant channel for loan origination. In 2023, digital platforms were already gaining momentum, especially in personal loans and SME finance. Analysts expected that more consumers would bypass traditional banks in favour of fintechs offering quick approvals and seamless digital experiences. This prediction largely came true. By 2024, digital channels accounted for more than 60 % of new personal loans in many developed markets and even higher percentages in emerging markets where smartphone adoption is high. Banks responded by investing heavily in their own digital platforms or partnering with fintechs. Open banking APIs facilitated real‑time data sharing, enabling instant credit decisions. The lesson from this prediction is clear: convenience and accessibility drive adoption. Lenders that neglect digital channels risk losing market share.

However, the story is nuanced. While digital lending grew overall, the market segmented into three tiers. First, large banks with strong digital capabilities maintained or even increased their share by leveraging brand trust. Second, agile fintechs captured specific niches such as gig workers or online merchants. Third, smaller community banks struggled to keep up due to limited technology budgets. As a result, regulatory bodies in some countries introduced schemes to support technology adoption among small lenders. Additionally, the importance of human interaction did not disappear. Complex products like mortgages or corporate loans continued to involve human advisors, even as digital tools streamlined documentation and underwriting. The takeaway is that while digital channels dominate, hybrid models remain relevant.

Prediction 2: Interest Rates Will Suppress Borrowing

Another prediction was that rising interest rates in response to inflation would dampen borrowing. This assumption is grounded in the idea that higher costs discourage consumers and businesses from taking loans. In reality, the impact was mixed. In 2023 and 2024, central banks in the U.S., Europe and India raised benchmark rates. Mortgage volumes declined in markets like the U.S., where 30‑year fixed‑rate loans are sensitive to rate hikes. However, consumer spending remained resilient, and demand for unsecured personal loans grew, particularly for home improvements, education and travel. In emerging markets, where many loans are variable rate, borrowers adjusted their budgets rather than postponing borrowing. Credit card balances increased as consumers spread expenses, though defaults rose slightly.

For businesses, the picture varied by size and sector. Large corporations accessed capital markets or retained profits, reducing dependence on bank loans. Small and medium enterprises (SMEs), however, still relied on bank credit and fintech lenders. Government support schemes and guarantees helped mitigate the impact of higher rates. As inflation eased in 2024 and 2025, central banks began moderating rate increases. Borrowing rebounded, especially in property markets. Thus, the prediction that high interest rates would severely suppress lending proved only partially accurate. Borrowers adapted, and lenders introduced flexible products to manage interest rate risk. Looking ahead, lenders must remain agile, offering variable and fixed options, and hedging their portfolios against rate volatility.

Prediction 3: Alternative Lending Models Will Surge

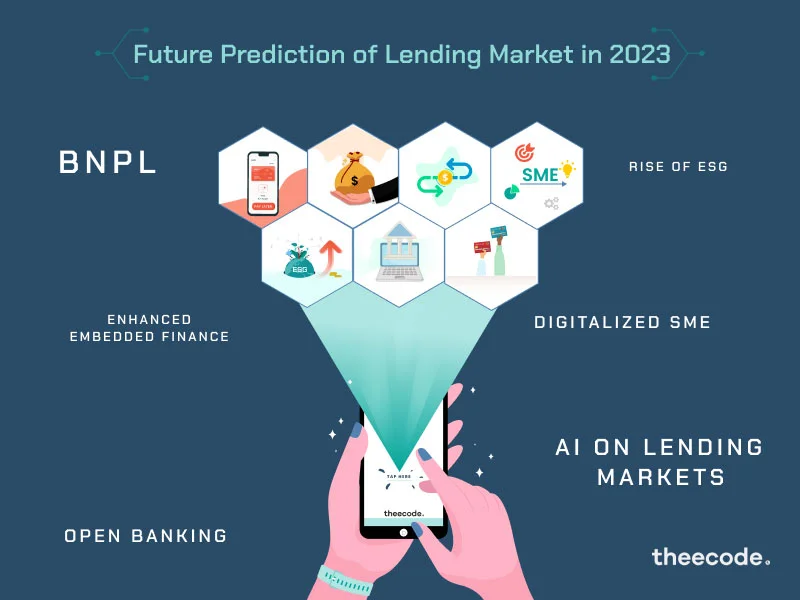

In 2023, the spotlight was on alternative lending models—peer‑to‑peer (P2P) platforms, buy now pay later (BNPL) programmes, embedded finance and revenue‑based financing. Pundits predicted explosive growth, particularly in BNPL, which allows consumers to split purchases into interest‑free instalments. Indeed, BNPL expanded rapidly across e‑commerce platforms, with providers such as Afterpay, Klarna and Zip gaining millions of customers. However, regulatory scrutiny increased after concerns about consumer indebtedness surfaced. Several jurisdictions mandated disclosures, credit checks and caps on fees. These measures slowed growth but improved transparency. P2P lending, once heralded as a bank‑disruptor, saw consolidation. Many platforms pivoted to institutional funding, as retail investor participation waned due to rising defaults in an uncertain economy.

Revenue‑based financing (RBF), which ties loan repayments to the borrower’s revenue performance, gained popularity among startups and small businesses seeking flexibility. Embedded finance—the integration of lending into non‑financial platforms like e‑commerce, ride‑sharing and SaaS—also blossomed. As predicted, merchants and gig platforms partnered with banks and fintechs to offer working capital and personal loans. By 2025, embedded lending accounts for a significant portion of small business financing in sectors such as retail and hospitality. The takeaway is that alternative models did surge, but regulatory oversight and risk management frameworks matured alongside them, ensuring sustainable growth.

Prediction 4: Regulation Will Intensify

Analysts expected regulatory scrutiny of lending to intensify in 2023. This prediction was accurate. Regulators focused on consumer protection, fair lending practices and fintech oversight. In the U.S., the Consumer Financial Protection Bureau issued guidelines for BNPL, payday lending and earned wage access programmes. The European Union advanced its Digital Finance Strategy, emphasising open finance and ethical use of AI in credit decisions. India implemented the Digital Personal Data Protection Act, impacting how lenders collect and process data. Anti‑money laundering and know‑your‑customer requirements tightened globally. While some industry participants viewed these measures as burdensome, they ultimately contributed to trust and stability. Well‑capitalised lenders with strong compliance frameworks thrived, while those skirting regulations faced penalties or shutdowns. Going forward, regulation will continue to evolve to address emerging risks such as AI bias, data privacy and cross‑border payments. Lenders must invest in compliance technology and engage proactively with regulators.

Prediction 5: ESG and Social Lending Will Grow

Environmental, Social and Governance (ESG) principles were expected to influence lending decisions. In 2023, many financial institutions pledged to align portfolios with climate goals and social impact. Sustainable lending products, such as green mortgages and loans tied to energy efficiency improvements, were predicted to grow. This trend accelerated in 2024 and 2025. Governments introduced incentives for green lending, including tax breaks and guarantees. Banks created frameworks to measure carbon footprints of borrowers and encouraged them to adopt sustainable practices. Social impact lending programmes targeted underserved communities, women‑owned businesses and minority entrepreneurs. Fintechs developed credit models that incorporated ESG factors. However, challenges remained around standardising metrics and avoiding greenwashing. Data transparency and third‑party audits became essential. Overall, the prediction of ESG growth proved accurate, and it continues to shape product development and risk management.

Unforeseen Developments

While many predictions were accurate, unexpected developments also influenced the lending market. One was the rapid advancement of generative AI. By 2024, large language models and AI assistants were integrated into customer service, underwriting and compliance processes. Lenders used AI to generate customised loan documents, converse with borrowers in natural language and detect anomalies in data. This improved efficiency but raised questions about explainability and bias. Another surprise was the speed at which some central banks implemented digital currencies (CBDCs). While still in pilot stages, CBDCs have the potential to disrupt traditional payment rails and require lenders to adapt. Additionally, geopolitical events, such as sanctions and trade disputes, impacted cross‑border lending. Supply chain disruptions and commodity price spikes forced lenders to reconsider sectoral exposures. These unexpected factors highlight the need for agility and scenario planning.

Looking Ahead: Trends Shaping 2025 and Beyond

Based on the lessons of 2023 and subsequent developments, several trends will shape the lending market going forward. First is the continued convergence of lending and technology. AI, open banking, blockchain and APIs will enable real‑time, personalised credit. Second, regulatory frameworks will expand to cover data governance, AI ethics and cross‑border collaboration. Third, competition will intensify not only among banks and fintechs but also from tech giants and non‑traditional players such as retailers and telecom operators. Fourth, ESG considerations will become embedded in all lending decisions, with lenders expected to provide transparent impact reporting. Finally, economic volatility—from climate events to geopolitical tensions—will require robust risk management and flexible product structures.

The journey from prediction to reality shows that while forecasts provide valuable guidance, the future is always shaped by a combination of expected trends and surprising developments. Lenders that embrace innovation, maintain resilience and prioritise customer trust will be best positioned to navigate whatever comes next. As we look back on 2023 from the perspective of 2025, we see a lending landscape that has become more digital, more inclusive and more complex. The next chapter will demand even greater agility and collaboration between regulators, technology providers and financial institutions.

Conclusion

Revisiting the predictions for 2023 highlights both the foresight and the limitations of forecasting. Digital lending did dominate, but it coexists with human‑centric models. Interest rate hikes did not uniformly suppress borrowing. Alternative lending models thrived under greater oversight. Regulation intensified, and ESG considerations gained prominence. At the same time, generative AI and geopolitical dynamics introduced new variables. As we move into the second half of the decade, lenders must balance innovation with responsibility. By learning from past predictions and embracing adaptability, the industry can continue to meet the evolving needs of borrowers and contribute to sustainable economic growth.