B2B2C Business Model in Lending

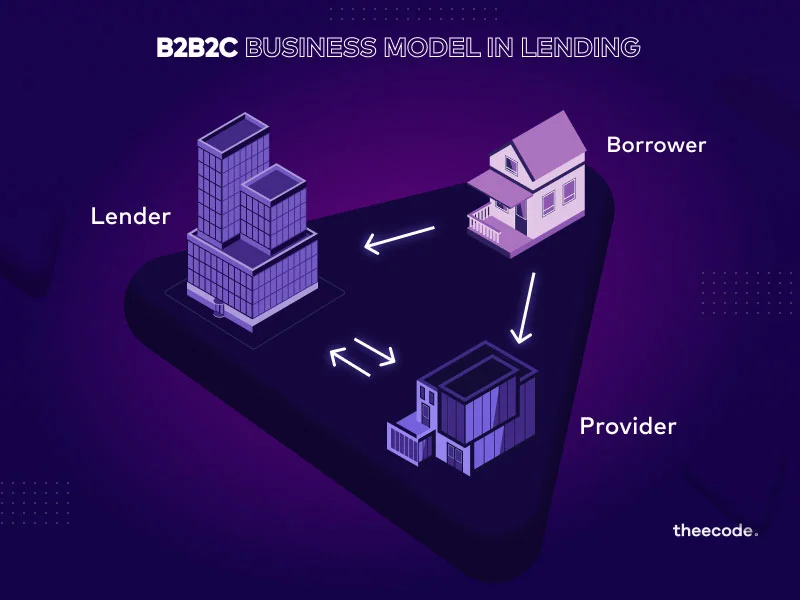

The financial services landscape is undergoing a paradigm shift as new technologies enable business models that were impossible just a decade ago. Among the most disruptive is the B2B2C (business‑to‑business‑to‑consumer) model, which sits at the intersection of wholesale and retail finance. In the context of lending, B2B2C refers to a structure where a lender provides capital and infrastructure to an intermediary business (B2B), who then offers loans to its own end customers (B2C). This intermediary might be an e‑commerce platform, a gig‑economy marketplace, a logistics firm or a software provider. By leveraging the intermediary’s distribution network, the lender gains access to a large base of potential borrowers who can obtain credit seamlessly as part of their everyday interactions. For end consumers, B2B2C lending reduces friction and makes credit accessible in contexts where it was previously unavailable or cumbersome to secure.

To appreciate the significance of B2B2C, it helps to contrast it with traditional models. Conventional lending is either B2B—think of banks providing working capital to small enterprises—or B2C, such as personal loans to individuals. Each model has its own strengths and limitations. B2B lending deals with larger tickets and offers scale, but the customer base can be limited and risk concentrated. B2C lending reaches many borrowers, but ticket sizes are small and customer acquisition costs can be high. B2B2C combines the best of both worlds. By tapping into an existing business’s ecosystem, lenders gain scale and rich data about consumer behaviour. The business partner benefits by enhancing its value proposition—offering credit to customers can increase loyalty and drive higher spending. Meanwhile, consumers enjoy instant credit decisions and seamless checkout experiences. This triadic model aligns incentives across all participants and is increasingly seen as the blueprint for embedded finance.

The Evolution of B2B2C Lending

Although the term B2B2C is relatively new, its principles have been around for centuries. Department stores in the early 20th century often offered hire‑purchase agreements to shoppers, effectively financing their purchases through in‑house credit. These programmes were managed and funded by banks behind the scenes. However, the digital era has taken B2B2C to new heights. With the proliferation of smartphones, cloud computing and application programming interfaces (APIs), lenders can embed credit products directly into third‑party platforms. This embedding allows a gig worker on a ridesharing app to apply for a vehicle loan without leaving the app, or a small merchant on an e‑commerce marketplace to receive working capital based on real‑time sales data. Payment service providers like Square and Stripe have launched lending products for merchants, leveraging transaction data to underwrite loans. These examples illustrate how the digital infrastructure has collapsed the boundaries between financial and non‑financial services.

The shift toward B2B2C in lending has been accelerated by the changing competitive landscape. Fintech startups have challenged traditional banks by focusing on specific pain points, such as financing for online sellers or loans for gig workers. Meanwhile, large technology companies have discovered that offering financial services can deepen customer engagement. Amazon’s small business lending programme, for instance, extends credit to sellers on its platform, while platforms like Shopify have rolled out capital advances based on merchant sales. These programmes rely on data that only the platform possesses, giving them an underwriting edge. In response, many banks have formed partnerships with fintechs and platforms to maintain relevance. The result is an ecosystem where lenders, businesses and consumers are interdependent. Each party contributes something unique: the lender brings balance sheet and regulatory expertise; the business provides distribution and data; and the consumer contributes transaction volumes and feedback loops.

Designing a Successful B2B2C Lending Programme

Building a B2B2C lending programme is not as simple as adding a “Pay Later” button. It requires careful alignment of goals, processes and technology. The first step is selecting the right partner. Not every business is equipped to offer financial products. Ideal partners are those with a large customer base, reliable transaction data and a customer relationship that is sticky. For example, a B2B SaaS provider that invoices thousands of small businesses monthly can identify which customers are experiencing growth and which are struggling, making it a fertile ground for lending. Conversely, a company with volatile revenues and high churn may not be suitable. Once the partner is chosen, the lender must integrate its systems through APIs to ensure real‑time data flow. This integration enables instant underwriting decisions and dynamic credit limits that adjust as the customer’s circumstances evolve. Without tight integration, the programme risks delays and errors, undermining the promise of seamless credit.

Underwriting in a B2B2C model must consider both the intermediary business and the end consumer. The intermediary’s financial health affects repayment because the credit is often repaid through the platform’s earnings or transaction flows. For instance, if a ridesharing platform experiences a downturn, drivers may see lower incomes and struggle to repay vehicle loans. Similarly, the platform’s operational stability—its ability to onboard new customers, maintain service quality and adapt to regulatory changes—affects credit risk. Therefore, lenders conduct due diligence on partners, reviewing their financials, compliance posture and technology capabilities. At the consumer level, data from the intermediary offers insights beyond traditional credit scores. A merchant’s sales velocity, return rates and customer feedback can all inform credit decisions. Combining these datasets allows for more precise risk segmentation and customised pricing. Pricing should reflect the reduced acquisition cost and lower default risk associated with closed‑loop ecosystems, passing on savings to the consumer while maintaining profitability.

Benefits and Challenges

The benefits of B2B2C lending are manifold. For lenders, it offers rapid scale without the need for large marketing budgets. Acquiring customers through a partner is often cheaper than direct acquisition, as marketing costs are shared or eliminated. Access to non‑traditional data improves underwriting accuracy, leading to lower default rates. Moreover, the recurring transaction flows through the partner platform simplify repayment and reduce fraud. For business partners, offering embedded finance increases customer stickiness. A merchant who receives a loan through an e‑commerce platform is more likely to keep selling on that platform. Similarly, a ridesharing driver with a vehicle loan tied to the platform is incentivised to stay active. Embedding lending also creates new revenue streams, as partners may receive origination fees or a share of interest income. Consumers benefit from convenience and inclusivity. Many small businesses and gig workers are underserved by traditional banks due to lack of collateral or limited credit history. B2B2C lending leverages real‑time operational data to extend credit to these segments quickly and at competitive rates.

Despite its promise, B2B2C lending presents challenges. Data privacy and security are paramount. Sharing customer data between parties must comply with regulations like the General Data Protection Regulation (GDPR) and India’s Digital Personal Data Protection Act. Clear customer consent and data governance frameworks are essential. Additionally, risk alignment between partners can be tricky. If a partner pushes loans aggressively to boost sales, it may compromise credit quality. Contracts should therefore include provisions for risk sharing and quality controls. There is also the risk of concentration. Lenders that rely heavily on a single platform expose themselves to systemic risk if the platform declines. Diversifying partners and monitoring platform health are critical risk management strategies. Finally, regulatory compliance is complex. Many jurisdictions require lenders to be licensed even if credit is offered via a partner. Fintechs and non‑bank lenders must navigate these rules while ensuring their partners do not inadvertently engage in unlicensed lending. Transparent communication and robust legal frameworks are thus crucial to programme success.

Case Studies: Global Perspectives

Several successful B2B2C lending programmes illustrate the model’s potential. In India, for example, a leading e‑commerce platform launched a seller lending programme in collaboration with a non‑bank financial company (NBFC). Sellers could access credit lines based on their monthly sales, which were automatically repaid from future earnings. The platform provided real‑time sales data to the lender, enabling dynamic credit limits. Within two years, the programme disbursed billions of rupees and reported non‑performing asset ratios significantly below the industry average. Sellers used the funds to manage inventory, launch marketing campaigns and expand product offerings, driving growth for both the sellers and the platform.

In the United States, fintech firms have partnered with point‑of‑sale platforms to offer “buy now, pay later” (BNPL) financing for retail consumers. These lenders underwrite loans based on the consumer’s transaction history with the merchant and real‑time credit data. The merchants, in turn, enjoy increased conversion rates as consumers spread payments over time. Unlike traditional credit cards, BNPL programmes have simple interest structures and transparent terms. However, regulators have begun scrutinising BNPL products due to concerns about consumer debt accumulation. This highlights the need for responsible lending practices even within B2B2C models. In Southeast Asia, ride‑hailing platforms have launched vehicle financing programmes for drivers in partnership with banks. The platform collects repayments directly from fares, reducing default risk. Drivers gain access to credit that was previously inaccessible, while banks tap into a new customer segment. These case studies underscore the global relevance of B2B2C lending and the diverse ways it can be executed.

The Role of Technology and Data

Technology is the backbone of B2B2C lending. Modern APIs enable secure data exchange between lenders and business partners, while machine learning algorithms process vast datasets in real time. For example, credit decision engines can score thousands of micro‑transactions per second, assessing risk without manual intervention. Cloud infrastructure allows these systems to scale elastically as transaction volumes fluctuate. Additionally, artificial intelligence enhances fraud detection. By analysing device fingerprints, user behaviour and payment patterns, AI models can flag suspicious activity before loans are disbursed. Chatbots and self‑service portals further streamline the customer experience, allowing borrowers to apply for and manage loans via the partner’s platform without human assistance. Data analytics also drives product innovation. Platforms can experiment with different loan sizes, repayment frequencies and incentives, using A/B testing to determine which features maximise repayment and customer satisfaction.

Data partnerships expand the possibilities even further. Open banking frameworks grant lenders access to bank account data (with customer consent), enabling holistic assessments of income and expenditure. When combined with platform data, this creates a 360‑degree view of the borrower’s financial health. In emerging markets, telecom operators have partnered with lenders to leverage mobile airtime usage and top‑up patterns as credit signals. Such collaborations illustrate how B2B2C lending can extend credit to underserved populations by tapping into alternative data. However, these opportunities must be balanced with ethical considerations. Customers should understand how their data is used, and lenders must implement robust security protocols to prevent breaches. Responsible data use will become a competitive differentiator as regulators and consumers demand greater transparency.

Future of B2B2C Lending

As embedded finance gains momentum, the B2B2C model will likely become the default for consumer credit and small business finance. We can expect to see deeper integration between lenders and platforms, with credit products seamlessly woven into supply chains, online marketplaces and gig‑economy ecosystems. Artificial intelligence will evolve from descriptive and predictive analytics to prescriptive solutions, suggesting optimal loan structures and customised repayment schedules. Smart contracts on blockchain networks may automate disbursement and repayment, reducing administrative overhead and improving transparency. Regulatory sandboxes could facilitate experimentation, allowing lenders and partners to test innovative products under regulatory oversight. Additionally, the convergence of financial services with other industries—such as healthcare, education and energy—will open new frontiers for B2B2C lending. For instance, energy companies could offer microloans for solar installations embedded in electricity bills, while educational platforms might provide student loans based on course completion rates and employment outcomes.

However, the future also brings challenges. As B2B2C lending becomes mainstream, competition will intensify. Differentiating on pricing alone will be unsustainable. Lenders and platforms will need to invest in customer experience, transparency and responsible lending practices to build trust. Regulators will likely impose stricter data governance and capital adequacy requirements, raising barriers to entry. Interoperability standards for data sharing will need to be established to prevent fragmentation. The role of central banks in providing infrastructure—such as digital currency rails and real‑time payment systems—will influence the design of B2B2C programmes. Ultimately, success in B2B2C lending will hinge on collaboration between financial institutions, technology providers, regulators and consumer advocates. Those that embrace these partnerships and invest in technology, risk management and customer centricity will be best positioned to thrive.

Conclusion

The B2B2C business model represents a fundamental reimagining of how credit is delivered. By connecting lenders, business platforms and consumers in a cohesive ecosystem, B2B2C aligns incentives and unlocks new sources of value. It leverages rich data and technology to underwrite risk more accurately, making credit accessible to segments previously overlooked by traditional finance. While challenges around data privacy, risk sharing and regulation must be navigated, the benefits—lower acquisition costs, enhanced customer experience and diversified revenue streams—are compelling. As the line between finance and commerce continues to blur, the B2B2C model will be at the forefront of innovation. Lenders that adapt to this paradigm—and partners that recognise the value of embedded finance—will be well positioned to shape the future of credit delivery, driving financial inclusion and economic growth in the process.