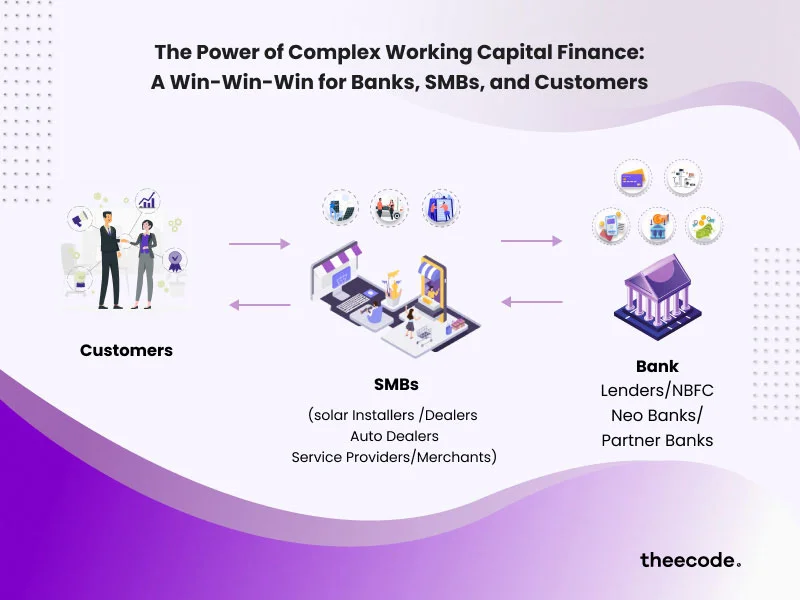

The Power of Complex Working Capital Finance: A Win‑Win‑Win for Banks, SMBs and Customers

Cash is the lifeblood of any business. For small and medium‑sized businesses (SMBs), cash flow gaps can hinder growth, delay payments to suppliers and jeopardise relationships with customers. Traditional working capital solutions, such as overdrafts or short‑term loans, offer relief but can be expensive and inflexible. In recent years, more complex forms of working capital finance—such as supply chain finance, dynamic discounting and receivables purchasing—have gained prominence. These solutions create a win‑win‑win scenario, benefiting banks that provide the financing, SMBs that need liquidity and customers that rely on the goods and services produced. This article examines how complex working capital finance works, why it is growing and what it means for participants across the value chain.

At the heart of working capital finance is the concept of the cash conversion cycle: the time it takes for a business to convert inventory and accounts receivable into cash. For SMBs, this cycle can span weeks or months. During this period, companies must pay suppliers, employees and other expenses. If receivables are not collected in time, businesses may face liquidity crunches. Traditional solutions like lines of credit provide a buffer but often come with high interest rates and stringent covenants. Complex working capital solutions align financing with the flow of goods and payments, reducing costs and improving efficiency. They leverage data, technology and relationships to create funding structures that benefit all parties.

Supply Chain Finance: Strengthening Relationships

Supply chain finance (SCF) is a set of financial products that allows suppliers to receive early payment on their invoices while buyers extend payment terms. Here’s how it works: a supplier delivers goods to a buyer and submits an invoice. Rather than waiting 30, 60 or 90 days for payment, the supplier can request early payment through a finance provider—often the buyer’s bank. The bank pays the supplier at a discount and collects full payment from the buyer at invoice maturity. Because the buyer’s creditworthiness backs the transaction, financing costs are lower than the supplier would obtain on its own. The buyer benefits by preserving working capital and strengthening relationships with suppliers, who gain liquidity. Banks earn fees and strengthen their ties with corporate clients.

SCF programmes have grown rapidly. Multinational companies like Walmart, Siemens and Unilever operate global SCF platforms. For SMBs, the concept is equally beneficial. A small manufacturer that supplies components to a large corporation may struggle with long payment terms. Through SCF, it gains access to low‑cost financing tied to the buyer’s credit rating. SCF platforms have digitalised the process, automating invoice matching, credit approval and payment. Fintech providers such as C2FO, Taulia and PrimeRevenue offer marketplaces where suppliers can request early payment on favourable terms. SCF illustrates how collaboration across the value chain can reduce financing costs and improve supply resilience.

Dynamic Discounting and Invoice Auctions

Another form of working capital finance is dynamic discounting, where buyers pay suppliers early in exchange for a discount that varies with the payment date. Unlike SCF, dynamic discounting typically uses the buyer’s own funds rather than bank financing. Buyers offer suppliers a sliding scale: the earlier the supplier accepts payment, the larger the discount. This enables suppliers to manage cash flow and buyers to earn higher returns on excess cash compared to bank deposits. Dynamic discounting platforms automate the negotiation of discount rates and manage the payment process. For SMBs, dynamic discounting provides flexibility; they can decide whether the cost of a discount is worthwhile based on cash needs.

Invoice auctions take a different approach. Instead of requesting early payment from a single buyer, suppliers sell receivables on a marketplace where investors bid for them. Platforms like MarketInvoice (now MarketFinance) and Invoicemart allow suppliers to upload invoices and set minimum discount rates. Multiple funders—banks, hedge funds or retail investors—bid to finance the invoices. The supplier selects the best offer, receives funds immediately and assigns the receivable to the buyer. Invoice auctions provide funding when the buyer is unwilling or unable to participate in SCF. They also introduce competition, which can lower discount rates. For investors, receivables are short‑duration, asset‑ backed exposures with attractive yields. Together, dynamic discounting and invoice auctions broaden the toolkit for working capital finance.

Reverse Factoring and Payables Financing

Reverse factoring (also called payables financing) resembles supply chain finance but is initiated by the buyer rather than the supplier. In this arrangement, the buyer’s bank or a fintech platform pays suppliers upon invoice approval and collects repayment from the buyer later. The difference between reverse factoring and traditional SCF is that the buyer drives adoption and may offer the programme to many suppliers. This centralisation simplifies onboarding and ensures consistent terms. For SMB suppliers, reverse factoring provides the security of guaranteed payments and eliminates the uncertainty of waiting for buyers to pay. Buyers improve supplier stability and may negotiate longer payment terms. Financiers earn a spread between the discount rate paid to suppliers and the cost of funds.

Payables financing is becoming more sophisticated with technology integration. Platforms connect to enterprise resource planning (ERP) systems, automate invoice verification and calculate discounts in real time. They can handle cross‑border payments, currency conversion and compliance checks. For example, a supplier in Vietnam can receive early payment in local currency for goods sold to a buyer in Germany, with the platform managing foreign exchange. This globalisation of payables financing opens opportunities for SMBs in emerging markets to participate in global supply chains without liquidity constraints.

Benefits for Banks, SMBs and End Customers

Complex working capital solutions create a symbiotic ecosystem. Banks and financiers benefit from diversified revenue streams that are often less risky than unsecured lending. Because these products are tied to trade flows and specific receivables, default rates are lower. Banks also strengthen relationships with corporate clients by offering holistic solutions beyond traditional loans. For SMBs, these solutions provide liquidity, reduce financing costs and enable participation in large value chains. Improved cash flow allows businesses to invest in growth, pay employees on time and negotiate better terms with suppliers. End customers indirectly benefit as well. Stable suppliers ensure product availability, reduce the risk of shortages and contribute to price stability. When SMBs are financially healthy, they can offer competitive pricing, invest in quality and innovate to meet customer needs.

Moreover, working capital finance promotes sustainability in supply chains. Programmes can include ESG criteria, incentivising suppliers to adopt environmentally friendly practices. For example, buyers might offer better discount rates to suppliers with strong environmental credentials. Financial inclusion is another benefit. Small suppliers that lack collateral can access credit based on the buyer’s credit rating. This supports entrepreneurship in emerging markets and helps reduce poverty. In this way, complex working capital finance has a social impact beyond financial efficiency.

Challenges and Mitigation Strategies

Despite its benefits, complex working capital finance involves risks and challenges. One is credit concentration. If a programme is heavily reliant on a single large buyer, the failure of that buyer could disrupt payments and cause losses. Diversification is essential; financiers should spread exposure across multiple buyers and industries. Another risk is operational. Programmes require robust technology to manage invoices, discount rates and disbursements. Errors or delays can erode trust. Cybersecurity is critical, as platforms handle sensitive data and large transactions. Regulatory risk must also be managed. Different countries have varying rules on assignment of receivables, late payment penalties and interest rate caps. Platforms and lenders must ensure compliance across jurisdictions. For SMBs, understanding the cost of financing and managing working capital effectively are vital. Over‑reliance on early payment programmes could mask underlying issues such as poor inventory management or weak buyer relationships.

Mitigation strategies include due diligence on buyers and suppliers, automated risk scoring and continuous monitoring of trade flows. Financiers should employ dynamic limits that adjust based on real‑time performance. Insurance and credit guarantees can cover extreme events. Transparent communication with participants builds trust. Training and support for SMBs ensure they use programmes judiciously. Collaboration between banks, fintechs and corporates is key to creating sustainable programmes. By addressing risks proactively, complex working capital finance can deliver on its promise of a win‑win‑win outcome.

The Future of Working Capital Finance

Looking ahead, several trends will shape the evolution of working capital finance. Digitalisation will deepen. Platforms will integrate with blockchain and distributed ledger technologies, providing real‑time visibility of invoices, shipment data and payments. Smart contracts could automate payments once goods are received or services rendered, reducing disputes. Artificial intelligence will enhance risk assessment by analysing diverse data sources, including ESG metrics. The rise of e‑invoicing mandates in Europe and Asia will standardise invoice formats, facilitating automation. Cross‑border programmes will expand as trade becomes more globalised. Finally, environmental and social factors will become embedded in financing decisions, with buyers and financiers incentivising sustainable practices through discount rates and access to capital.

The broader context of economic uncertainty—due to geopolitical tensions, climate change and shifting consumer behaviour— makes working capital finance even more critical. SMBs must manage cash flows adeptly to weather disruptions. Banks and fintechs that invest in sophisticated working capital solutions will be able to support their clients through volatility and build long‑term relationships. By aligning incentives and leveraging technology, complex working capital finance will continue to deliver value across the supply chain.

Conclusion

Complex working capital finance—encompassing supply chain finance, dynamic discounting, reverse factoring and invoice auctions—offers a compelling alternative to traditional credit lines. By aligning financing with trade flows and leveraging the creditworthiness of buyers, these solutions reduce costs and improve liquidity for SMBs. Banks and financiers gain diversified income streams, while end customers benefit from stable supply chains and potentially better prices. Challenges around concentration risk, operations and regulation can be managed through technology, diversification and collaboration. As digitalisation accelerates and ESG considerations gain prominence, working capital finance will evolve into an even more strategic tool for businesses of all sizes. The outcome is a win‑win‑win that strengthens relationships across the value chain and supports sustainable economic growth.